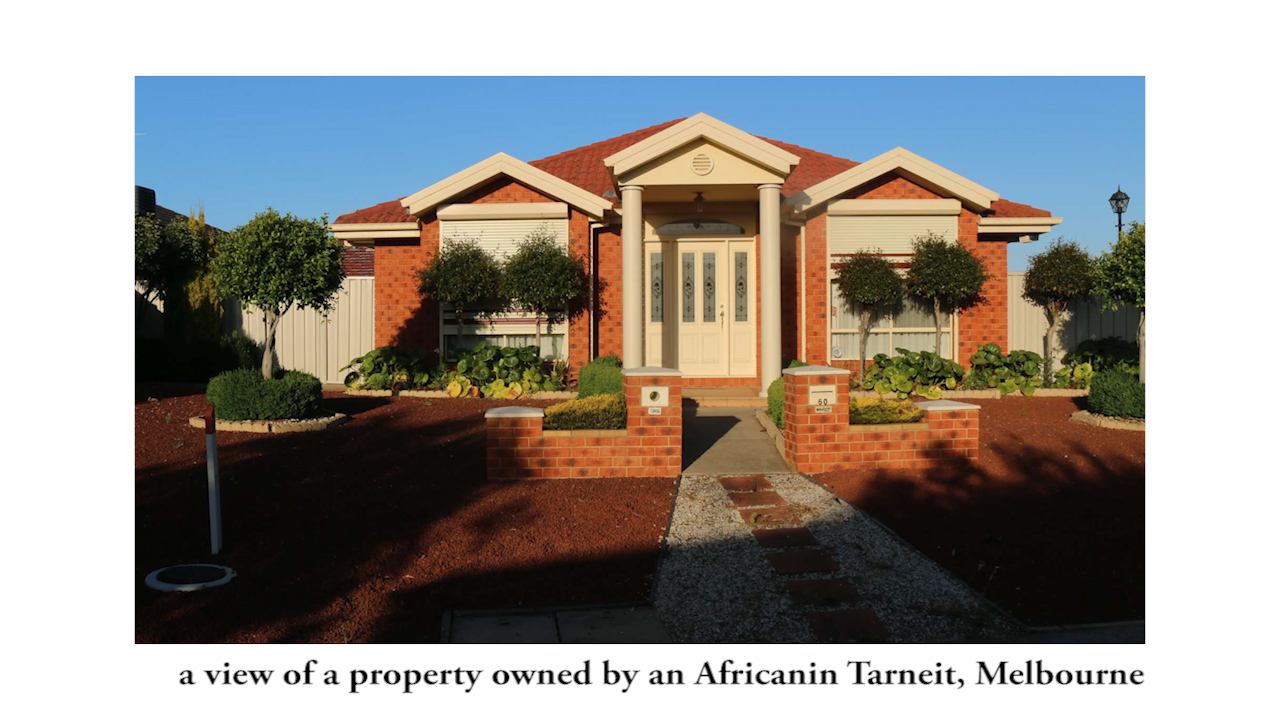

The city of Wyndham in Melbourne West is not just the fastest growing municipality in Australia, it is also home to increasingly more African-Australians. The suburbs of Tarneit, Truganina, Hoppers crossing and the surrounding areas now have one of highest concentrations of African-Australian homeowners in Melbourne and probably in the whole of Australia. It’s an encouraging sign for this new and emerging group of the Australian population whose members have often come from quite challenging backgrounds.

The city of Wyndham in Melbourne West is not just the fastest growing municipality in Australia, it is also home to increasingly more African-Australians. The suburbs of Tarneit, Truganina, Hoppers crossing and the surrounding areas now have one of highest concentrations of African-Australian homeowners in Melbourne and probably in the whole of Australia. It’s an encouraging sign for this new and emerging group of the Australian population whose members have often come from quite challenging backgrounds.

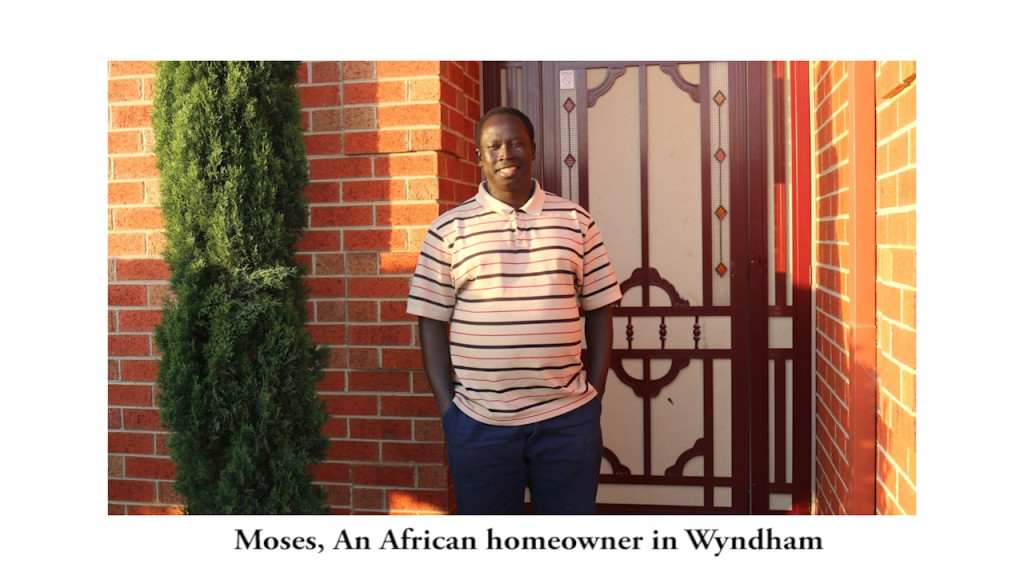

Moses, a South-Sudanese Australian resident of Tarneit since 2008 says that “African-Australians are moving in the Wyndham area in big numbers and they are not just renting, they are buying houses because there are more affordable house and land packages that are made available here compared to other areas of Melbourne and beyond”.

Whilst there are no official statistics about home ownership within African-Australian communities, anecdotal evidence suggests that the percentage of Africans now living in their own mortgaged properties is probably the highest it has ever been since Africans started entering Australia en masse, approximately 30 years ago. The city of Wyndham in Melbourne West and the city of Greater Dandenong in South-East, as well as Whittlesea in the North of Melbourne are the main areas where many Africans are now buying houses in big numbers.

Nick Tshibala is a Congolese-born Australian who has been a Wyndham resident for over ten years. He applauds the growth of home ownership amongst Africans in general and in his local area in particular. “Its a great thing that Africans are now more settled and they are integrating better in Australia than before, taking up the Australian culture which views home ownership as an essential thing in life”, he said.

This father of three says “Australia is not just my second home as most migrants would say, for me it is just my home, period. I am not thinking of going back to live in Africa and I am also pleased to see that many more africans are now working hard, learning to live like any other regular Aussie blokes and Sheilas and they see Australia as their home and their future, both for themselves and their children”.

The community mindset is changing

There is no doubt that the mindset is changing within African-Australian communities as they get a better understanding of the Australian culture and way of life and the many opportunities that are available for all citizens and residents. Increasingly more African-Australians understand that “rent money is dead money”, as the saying goes, and nowadays, with the interest rate being so low in borrowing money, the cost of renting is almost equal to mortgage repayment. So, even for those who are still thinking of returning to Africa one day, buying a house is a great investment as they can cash in before going home and return with a comfortable envelope.

“When we arrived in Australia in late 90s we didn’t have a good understanding of what a mortgage is and often we heard more about its negative aspect than its benefits, mainly because most Africans who were here before us did not own homes and viewed mortgage as a huge burden. But now things are changing and owning a home is now viewed very positively in our communities” said Nick.

There are many factors that are contributing to the growth of home ownership within Afro-Australian communities. There is an increase in the number of African skilled migrants who enter Australia with a lot of skills, knowledge and some good savings as many are actually coming from first world countries such as the UK or New-Zeland rather than directly from the African continent. This group of migrants are mainly from countries such as Nigeria, Zimbabwe, Kenya, South Africa and they get into Australia and hit the ground running. They waste no time to buy properties because they can afford to do this and they know how things work.

More entrepreneurship brings about financial power

Additionally, there are also increasingly more Africans involved in small businesses such as shops, money transfer agencies, restaurants and Family Day Care schemes and all of this helps to raise income in families and be able to qualify for home loans. Furthermore, the economic and fiscal conditions in Australia are now very favourable and this means that people can plan, budget and save money to afford purchasing a home, even those on low income jobs. Home loans have never been more accessible as the official interest rate is at the lowest point it has been for over 20 years.

Another important contributing factor in this growth is the fact that more African-Australian women are now employed than before, holding stable jobs in industries such as healthcare and childcare. Ten years ago, most African-Australian families were on a single income if they were not living on the dole, especially those families from a refugee background. For a long time it was often the case that the husband is employed and the wife stays at home to take care of the kids, but now this is no longer the case, women are working too and many are even earning more money than their spouses and with two streams of income in the family, it becomes very easy for to qualify for not just one home loan, but potentially more. The growth of the Family Day Care industry has brought a lot of positive change within African families as women can easily get the required qualification as educators and be able to provide care for children and earn a significant income in doing so.

More income within African families also means that those who are financially savvy are now also starting to invest in real estate, just like ordinary Australian families do. Nick Tshibala remarks that “Africans should now seek to study and understand the real estate industry for the numerous investment opportunities it provides for families. Many other newly established migrant groups such as Libanese, East-Europenas, Asians and Indians are very active in Real Estate investment, They learn the trades for building houses and they unite forces to build or renovate houses at low cost and rent or sell them for profit. Africans should do this too”.

CSS

If you are interested in buying a house for family or being part of an African Real Estate investment club, please contact us at info@africarisingaustralia.com or call/SMS 0437724469